Smart Money Concepts (SMC) in Crypto: The Complete, Actionable Guide

Master market structure, liquidity, and order-flow to trade like institutions in 24/7 crypto markets.

What Are Smart Money Concepts?

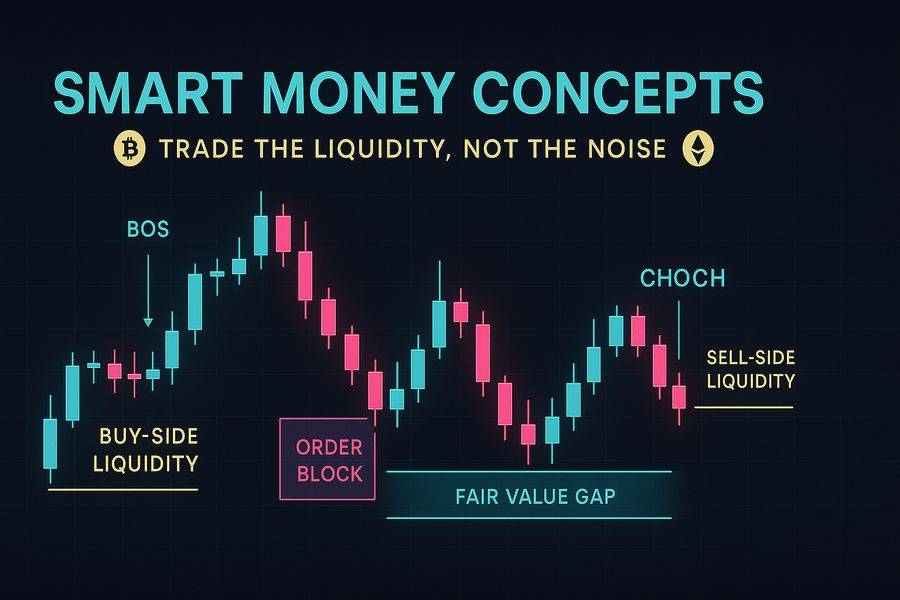

Smart Money Concepts (SMC) is a rules-based approach to reading price by focusing on how liquidity is created and taken by larger participants. Instead of classic indicator crosses, SMC emphasises: market structure shifts, liquidity pools (resting orders at obvious highs/lows), institutional footprints like order blocks, and imbalances known as fair value gaps.

SMC is not a single “holy grail” setup. It is a framework that aligns context (trend + liquidity) with precise location (OB/FVG/OTE) and disciplined execution.

basics. –>

The 6 Core Pillars of SMC

- Market Structure: Identify trend and shifts via BOS and CHoCH.

- Liquidity: Map where stops/limits sit (equal highs/lows, swing points, session highs/lows).

- Order Blocks (OBs): The last up/down candle before a strong displacement that often gets mitigated.

- Displacement: Impulsive move with large candles and body closes that break structure.

- Fair Value Gaps (FVGs): 3-candle inefficiencies that price often returns to fill.

- Premium/Discount: Use Fibonacci to locate value within a swing; seek shorts in premium and longs in discount.

Market Structure: BOS vs. CHoCH

Higher Highs/Lows (HH/HL) & Lower Highs/Lows (LH/LL)

Identify the current swing leg on H1–H4 for context; refine on M15–M5 for entries. A bullish market prints HH/HL; a bearish one prints LH/LL.

Break of Structure (BOS)

A BOS occurs when price closes beyond the most recent swing high (bullish) or swing low (bearish) in the direction of the prevailing trend. BOS confirms continuation.

Change of Character (CHoCH)

A CHoCH marks a potential trend reversal. It’s the first significant break against the prior trend, typically on displacement. After CHoCH, anticipate a pullback to an OB or FVG to enter with the new bias.

Liquidity: Equal Highs/Lows, Sweeps & Engineering

Liquidity pools form at equal highs/lows, previous day’s high/low, Asian range extremes, and round numbers. Smart money often engineers liquidity by allowing price to coil just beneath a high (or above a low), then sweeps the resting stops before reversing into the true move.

- Buy-Side Liquidity (BSL): Resting buy stops above swing highs/equal highs.

- Sell-Side Liquidity (SSL): Resting sell stops below swing lows/equal lows.

- Liquidity Sweep: A wick pierces BSL/SSL, collects stops, and closes back inside—often preceding reversal from OB/FVG.

Order Blocks (OB) & Mitigation

An order block is the last down candle before a bullish displacement (bullish OB) or the last up candle before a bearish displacement (bearish OB). They represent areas where institutions executed large positions. When price revisits these zones, unfilled orders may be mitigated, creating high-probability entries.

Refining an OB

- Prefer OBs that caused a clear BOS or CHoCH.

- Refine to the wick or the open of the OB for precise limits.

- Confluence with FVG or session levels > standalone OBs.

Fair Value Gaps (FVG) / Imbalance

A Fair Value Gap appears when a three-candle sequence leaves a void between Candle 1’s high and Candle 3’s low (bullish FVG) or Candle 1’s low and Candle 3’s high (bearish FVG). Price often rebalances these inefficiencies, making them ideal pullback targets after displacement.

- Partial vs. Full Fill: Not every FVG fully closes; many react on a 50% “mean threshold.”

- Stacked FVGs: Multiple imbalances in the same direction signal strong momentum; the nearest gap is often respected first.

Premium/Discount & OTE

Draw Fibonacci from swing low → swing high in an uptrend (reverse in downtrends). The 50% line divides discount (favorable for longs) from premium (favorable for shorts). The Optimal Trade Entry (OTE) zone typically sits between 62%–79% retracement, especially when it overlaps an OB or FVG.

A Complete SMC Strategy for Crypto

Timeframes & Pairs

- Bias: H4 → H1 (structure & key levels)

- Execution: M15 → M5 (entries using OB/FVG/OTE)

- Markets: BTC/ETH perps + 1–3 liquid alts; avoid illiquid pairs with erratic wicks.

Rules (Bullish Example)

- Identify CHoCH up on H1 with displacement.

- Mark the bullish OB that caused CHoCH and any bullish FVG left behind.

- Wait for a liquidity sweep of a nearby sell-side pool (e.g., Asian low, equal lows).

- On M15–M5, look for a BOS up after the sweep. Enter on:

- Limit at OB open/wick; or

- FVG 50% mean threshold; or

- Market entry on micro-BOS with tight invalidation.

- Stop below OB wick or below sweep low (structure-based).

- Targets: Prior swing high, opposing liquidity pool (BSL), session high, or a premium FVG.

- Manage: Reduce risk at +1R, partials at 2R–3R, trail below micro-HL or use ATR on execution TF.

Short Setup (Bearish Mirror)

Seek CHoCH down → mark bearish OB/FVG → wait for buy-side sweep → micro-BOS down → short from premium with stop above OB wick → target SSL at prior lows.

Session Logic (24/7 Crypto)

- Asia Range: Often sets liquidity. Mark its high/low for later sweeps.

- EU/US Overlap: Highest volume; look for displacement and BOS during this window.

- Funding Prints: Around funding turns, volatility can spike—mind execution.

Risk, Funding & Execution in Perps

Position Sizing

- Risk 0.25–1.0% per trade; crypto is volatile.

- Stops are structure-first; widen or pass if size becomes excessive.

Funding & Fees

- Positive funding punishes longs; negative funding punishes shorts. Include it in expected value.

- Prefer maker orders at OB/FVG levels to reduce fees and slippage.

Execution Tips

- Avoid chasing displacement candles; wait for mitigation into your level.

- Let price come to you; missed trades are part of the edge.

Backtesting, Journaling & Optimization

Data & Definitions

- Define what qualifies as displacement (e.g., body > prior average range + volume expansion).

- Standardize your OB/FVG drawing rules to avoid hindsight bias.

- Log session of entry (Asia/EU/US), funding rate, and volatility regime (ATR percentile).

Sample Rule Block (Pseudocode)

// LONG ENTRY (SMC)

Context: H1 CHoCH up + displacement; price in discount of H1 swing.

Level: Bullish OB overlapping bullish FVG (mean threshold) within 62–79% OTE.

Trigger (on M5): Liquidity sweep of equal lows → bullish micro-BOS.

Risk: Stop below sweep low; size for 1% account risk.

Targets: TP1 at +2R or opposing FVG; TP2 at BSL or prior day high; runner trails below M5 higher lows.Metrics to Track

- Win rate, average R multiple, max drawdown, time-of-day edge, funding-impact, slippage.

- Tag outcomes by confluence count (OB+FVG+OTE+Sweep) to find your A+ setups.

Common Mistakes & Myths

- Drawing everything as an OB: If it didn’t cause displacement + BOS/CHoCH, ignore it.

- Trading every sweep: A wick through liquidity is step one; require structure confirmation.

- Forcing entries in premium (for longs) or discount (for shorts): Location matters.

- Moving stops to breakeven too early: Let the trade reach a structural milestone first (e.g., first opposing FVG).

Printable SMC Checklist

- What is H1/H4 bias? BOS or CHoCH?

- Where are BSL/SSL pools (PDH/PDL, Asia range, equal highs/lows)?

- Which OB/FVG aligns with OTE (62–79%)?

- Do we have a sweep → micro-BOS trigger?

- Risk ≤ 1% with structure-based stop?

- Defined TP plan (opposing liquidity / FVG / session high/low)?

- Funding/fees acceptable? Volatility regime suitable?

FAQs

Is SMC only for day trading?

No. Use H4/H1 for swing bias and execute on M30–M5. Anchored levels (weekly highs/lows, weekly OBs) work well for multi-day holds.

How do I choose between OB and FVG?

Prefer the level that caused displacement and aligns with the OTE zone. If both align, treat as A+ and scale-in at each sub-level with pre-defined risk.

Does SMC work on altcoins?

Yes, but thin liquidity creates erratic wicks. Use wider stops and reduced size or focus on BTC/ETH during development.

What’s the best confirmation?

A liquidity sweep into your level followed by a decisive micro-structure BOS (e.g., M5 break and close) offers strong confirmation.

Can I combine SMC with indicators?

Absolutely. Use VWAP or EMAs for momentum filter; use volume profile for confluence at OB/FVG.

and . –>