Elliott Wave in Crypto: Complete Guide to Rules, Patterns & Strategy

Elliott Wave Theory (EWT) maps market psychology into repeatable price structures. In crypto—where trends can be explosive and corrections sharp—wave analysis can sharpen your timing, expectations, and risk controls. This guide covers the essentials, Fibonacci relationships, counting workflows, and ready-to-test strategy templates.

What Is Elliott Wave?

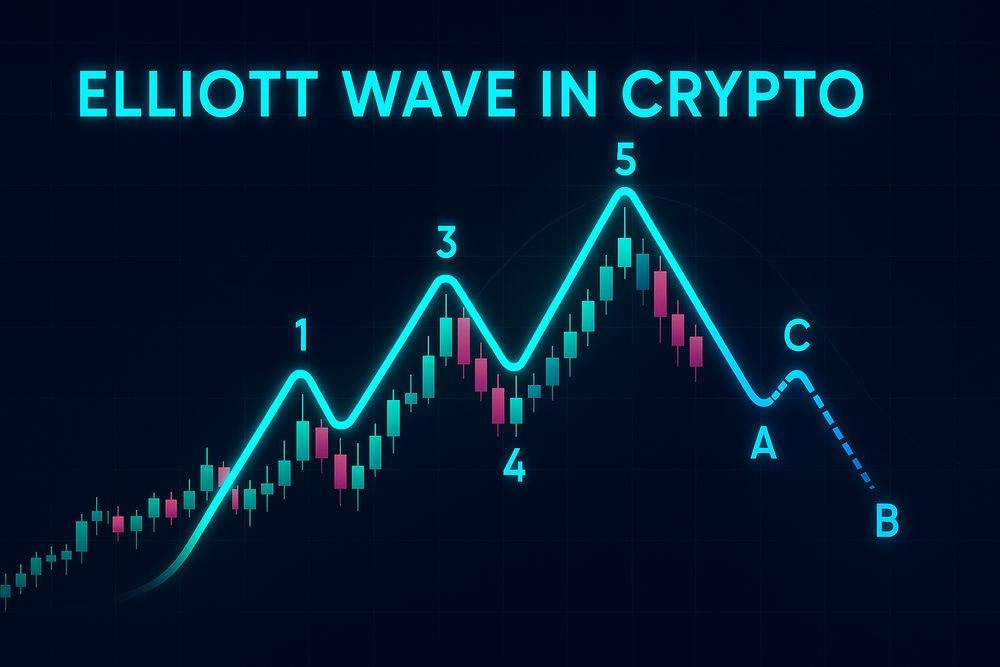

Elliott Wave Theory suggests trends unfold in a five-wave impulse (1–2–3–4–5), followed by a three-wave correction (A–B–C). Waves nest at multiple degrees—smaller waves build larger ones—producing self-similar structures across timeframes.

Used correctly, EWT sets expectations for where you are in a move (early, mature, or corrective), and helps plan entries/exits with rules and invalidation levels. Validate your trade math anytime with our Free Crypto Profit Calculator.

Impulse Waves: Rules & Guidelines

An impulse is a five-wave move in the trend direction. Key rules (for standard impulses):

- Rule 1: Wave 2 never retraces beyond the start of Wave 1.

- Rule 2: Wave 3 is never the shortest of Waves 1, 3, and 5 (often the longest and most powerful).

- Rule 3: Wave 4 does not overlap Wave 1 price territory (exceptions exist in diagonals).

Guidelines: one impulse wave often extends (commonly Wave 3 or 5 in crypto). Expect alternation between Waves 2 and 4 (if Wave 2 is sharp, Wave 4 is often sideways, and vice versa). Use channeling to project Wave 5: draw a channel around Waves 1–3 and project a parallel from Wave 2.

Diagonal Variants

- Leading diagonal: appears in Wave 1 or A; overlaps allowed; structure is wedge-like (5-3-5-3-5 or 3-3-3-3-3).

- Ending diagonal: appears in Wave 5 or C; signals trend exhaustion; overlaps common.

Corrective Patterns: Zigzag, Flat, Triangle & Combinations

Corrections typically unfold in three waves (A–B–C), with distinct flavors:

- Zigzag (5–3–5): sharp, deep retracement; Wave A impulsive or leading diagonal.

- Flat (3–3–5): sideways correction; variants: regular, expanded (B exceeds start of A), running.

- Triangle (3–3–3–3–3): contracting/expanding; typically occurs as Wave 4 or B; breaks in the direction of the larger trend.

- Combinations (W–X–Y / W–X–Y–X–Z): link multiple simple corrections for complex ranges.

In crypto, expanded flats and running corrections are common during strong trends and news-driven wicks.

Fibonacci Relationships & Projections

- Wave 2 often retraces ~50–61.8% of Wave 1; Wave 4 often ~23.6–38.2% of Wave 3.

- Wave 3 commonly equals 1.618× Wave 1 (or 2.618× in very strong trends).

- Wave 5 often equals Wave 1, or 0.618× the net distance 0–3; parity/equality is frequent if Wave 3 extended.

- ABC targets: C ≈ A (equality) or 1.618× A in stronger corrections.

Use retracements to size pullbacks and extensions for projecting Wave 3/5 or Wave C targets. Confluence (structure + Fibonacci) improves selectivity.

Wave Degrees & Multi-Timeframe Alignment

Waves nest across degrees (subminuette → minute → minor → intermediate → primary, etc.). Align higher-timeframe (HTF) counts with lower-timeframe (LTF) execution:

- HTF (4h/1D): determine where you are in the cycle (e.g., Wave 3 vs Wave 5 vs Wave C).

- LTF (5m–1h): refine entries when LTF sub-waves align with HTF direction.

Counting Workflow: Step by Step

- Identify swings: mark potential Wave 1–2 or A–B anchors.

- Project Fib zones: retracements for Wave 2/4; extensions for Wave 3/5/C.

- Apply rules: check for invalidations (e.g., Wave 2 not below start of Wave 1).

- Choose the simplest valid count: avoid forcing rare patterns when a common one fits.

- Use alternation & channeling: refine Wave 4 and 5 expectations.

- Plan trades: set entry triggers (candle close, structure break), stops at invalidation, and targets via structure/Fib.

Before placing risk, verify fees, TP/SL and ROI using: Free Crypto Profit Calculator.

Strategy Templates (with Objective Rules)

A) Wave-3 Breakout with Pullback

- Context: suspected Wave 2 complete; price breaks prior Wave 1 high with momentum → potential Wave 3.

- Entry: buy retest of broken level/structure; require strong candle close in trend direction.

- Stop: below retest low or below invalidation (prior Wave 2 low).

- Targets: Fib 1.618× Wave 1 for initial target; trail remainder.

B) End-of-Wave-5 Reversal (Exhaustion)

- Context: channel overshoot + bearish divergence on momentum; fifth-wave extension likely matured.

- Entry: short on structure break (lower low) or bearish engulfing after an overthrow.

- Stop: above the Wave 5 high.

- Targets: A–B–C retrace: first target at 38.2–50% of the entire 0–5 move; deeper targets if A–B–C evolves.

C) ABC Completion (Zigzag) into Trend Resumption

- Context: after a 5-wave impulse up, an A–B–C correction unfolds.

- Entry: look for Wave C ≈ Wave A equality or 1.618× A into structure/Fib confluence; trigger on bullish close.

- Stop: beyond Wave C low.

- Targets: prior high; then trend extensions.

Risk Management & Trade Math

- Invalidation-based stops: place stops where the count breaks (e.g., under Wave 1 origin if you bet on Wave 3).

- Position sizing: risk a small fixed fraction (0.5–2%).

- Scaling: consider partials at key Fib targets (1.0/1.272/1.618) and structure levels.

- Costs: model fees, funding, slippage—crucial in low-timeframe trading.

- Correlation: cap exposure across highly correlated altcoins.

Check fee impact and ROI per trade here: Free Crypto Profit Calculator.

Backtesting & Optimization

Keep rules objective: define exactly how you confirm Wave 2 ends, what triggers Wave 3 entries, and where invalidations sit. Backtest across bull/bear/chop regimes with realistic frictions. Maintain a clean out-of-sample period; consider walk-forward validation.

Illustrative Rule Set

- Bias (HTF 4h/1D): impulse confirmed; anticipate Wave 3 or Wave C.

- Entry (LTF 15m/1h): break of Wave 1 high with momentum; buy the retest that holds.

- Stop: below retest low or below Wave 2 low.

- Targets: 1.618× Wave 1 for initial; trail remainder with structure or ATR.

Common Pitfalls & Crypto-Specific Tips

- Forcing counts: choose the simplest valid count; don’t retrofit rare patterns.

- Ignoring invalidations: EWT’s power is in where you’re wrong. Honor stops.

- Overconfidence in diagonals: overlaps are allowed in diagonals, but don’t overuse them as excuses.

- Crypto wicks: extreme wicks can briefly violate levels; consider close-based rules and ATR buffers.

- Parabolic Wave 5: blow-off tops are common; trail aggressively once extensions appear.

Ready to apply Elliott Wave—carefully?

Open accounts with top exchanges and start with small size after a solid paper-trade period:

Double-check fees, TP/SL and ROI here: Free Crypto Profit Calculator.

FAQ: Elliott Wave in Crypto

What are the core Elliott Wave rules for an impulse?

Wave 2 cannot retrace beyond the start of Wave 1; Wave 3 is never the shortest of 1/3/5; Wave 4 typically does not overlap Wave 1 (except in diagonals).

Which Fibonacci levels are most useful?

Wave 2 often retraces 50–61.8% of Wave 1; Wave 3 targets 1.618× Wave 1; Wave 4 often 23.6–38.2% of Wave 3; Wave 5 often equals Wave 1 or 0.618× (0–3).

How do I avoid miscounting?

Favor the simplest valid count, use invalidations strictly, and confirm with structure, momentum, and channeling. Don’t force rare patterns.

Can I trade Elliott Wave on low timeframes?

Yes, but execution costs rise. Use HTF bias for direction and LTF for entries; model fees/funding/slippage carefully.

What’s the difference between a zigzag and a flat?

Zigzag is 5–3–5 and sharp; flat is 3–3–5 and sideways (can be regular, expanded, or running).